The topic of the Digital Dollar became hot news recently when the U.S. House of Representatives scrambled to craft a draft bill that would authorize trillions of dollars in payments to Americans during the COVID-19 emergency relief efforts. In this bill they introduced the digital dollar concept, which was quickly scrapped when mainstream media started talking about a digital dollar as a cryptocurrency. Read all about it on Forbes.

So, what is a Central Bank Digital Currency (CBDC)? As stated by Investopedia here is the quick definition of what is CBDC.

“Central Bank Digital Currency (CBDC) represents the digital form a fiat currency of a particular nation (or region), and is issued and regulated by the competent monetary authority of the country.”

With COVID-19 there were two specific items that potentially triggered the discussion around a Digital Dollar becoming a reality;

1. Due to how long COVID-19 stuck around on any surfaces, the fear of contracting the virus by exchanging physical dollars caused people to go cashless overnight. This triggered discussion around if there is a need for a paper based currency in the post COVID-19 world.

2. Governments emergency payments to large populations had to be distributed quickly and efficiently. In this case the governments leveraged the banking systems to distribute the funds for a administrative fee but discussions started if a digital wallet could have been used to easily issue the funds in an efficient and low cost way.

Will we see a Canadian digital dollar from the Bank of Canada?

The Bank of Canada has published many research papers on the topic of CBDC, which you can read about here. As well, the Bank of Canada on February 25, 2020 officially published an article title; Contingency Planning for a Central Bank Digital Currency and concluded that.

“The Bank currently has no plans to launch a CBDC. Rather, the Bank will build the capacity to issue a general purpose, cash-like CBDC should the need to implement one arise. Because it will take several years to build this capacity, the Bank cannot wait until the need is evident before launching preparatory work. Preparing in advance is critical. At the same time, the Bank is preparing for a range of other possible changes to money and payments in Canada as innovation continues.”

The Bank of Canada also published a paper titled; Is Central Bank Currency Fundamental to the Monetary System? (last update May 5, 2020) that I found very unbiased and educational for anyone that is looking to understand the overall financial monetary system.

Who are the key players in the industry looking at options as to how a CBDC could be implemented?

I recently has the opportunity to attend a couple on-line events that discussed CBDC as it relates to the opportunities and challenges that come along with it.

First Workshop: A great discussion on CBDC was hosted by The Blockchain Hub from York University in Toronto. You can watch the re-play of this presentation at the following link. The presenters were Wayne Chan from Blockchain Research Institute, Daniel Eidan from R3 and Chetan Phull from Smart Block Law.

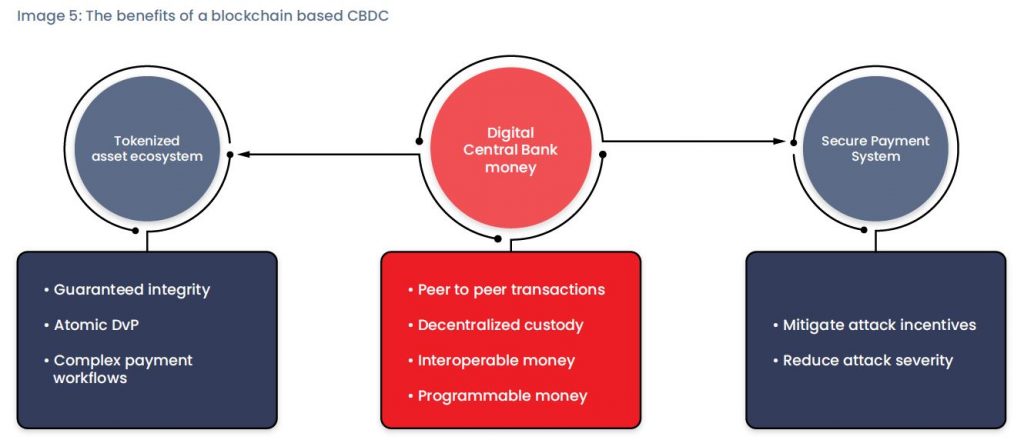

What could be the benefits of running a CBDC on blockchain? According to R3 they are the following

For more detail, please reference the White Paper by R3 titled Central Bank Digital Currencies: an innovation in payments.

How does the law apply to a CBDC in Canada? Would it be really considered “money” or “legal tender”?

For a more detailed explanation have a look at the Presentation by Chetan Phull from Smartblock Law titled CBDC Primer which will give you a better understanding of the legal aspects of money.

Second workshop was on CBDC at the Consensus Distributed 2020 by Coindesk on-line conference. The topic was “The Future of Central Bank Digital Currencies”, you can watch the re-play of the workshop at the following link.

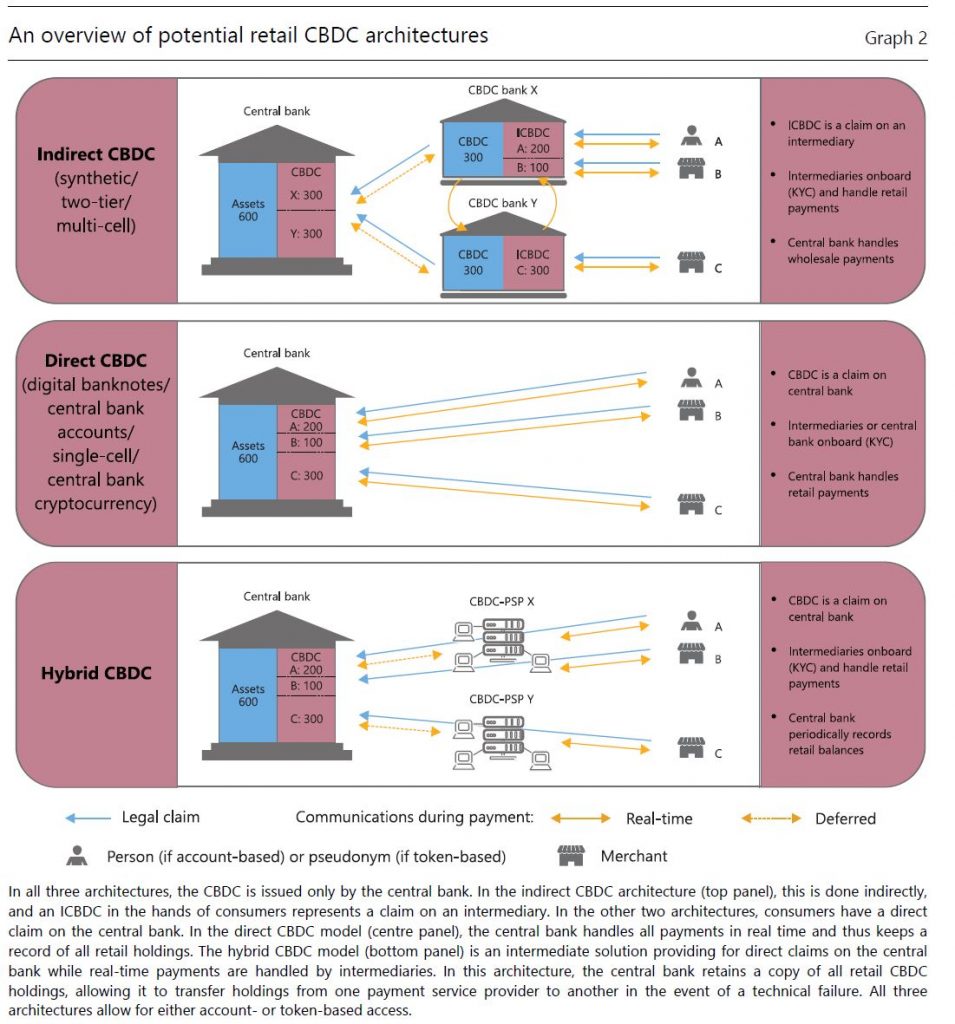

Raphael Auer from Bank of International Settlements (BIS) talked about the design considerations for a CBDC currency. His presentation was based on a recent paper released by the BIS titled “The Technology of Retail Central Bank Digital Currency” and you can download it from the following link.

What are the potential implementation approaches to CBDC deployment? In the released paper BIS presents three potential architecture options for CBDC implementation.

In conclusion, I would say that a digital dollar pilot in Canada is very likely in the next 5 years especially with the recent news from China that the People’s Bank of China is launching a pilot program to trial its new digital currency yuan with 19 local businesses, which include U.S. chains Starbucks, Subway and McDonald’s.